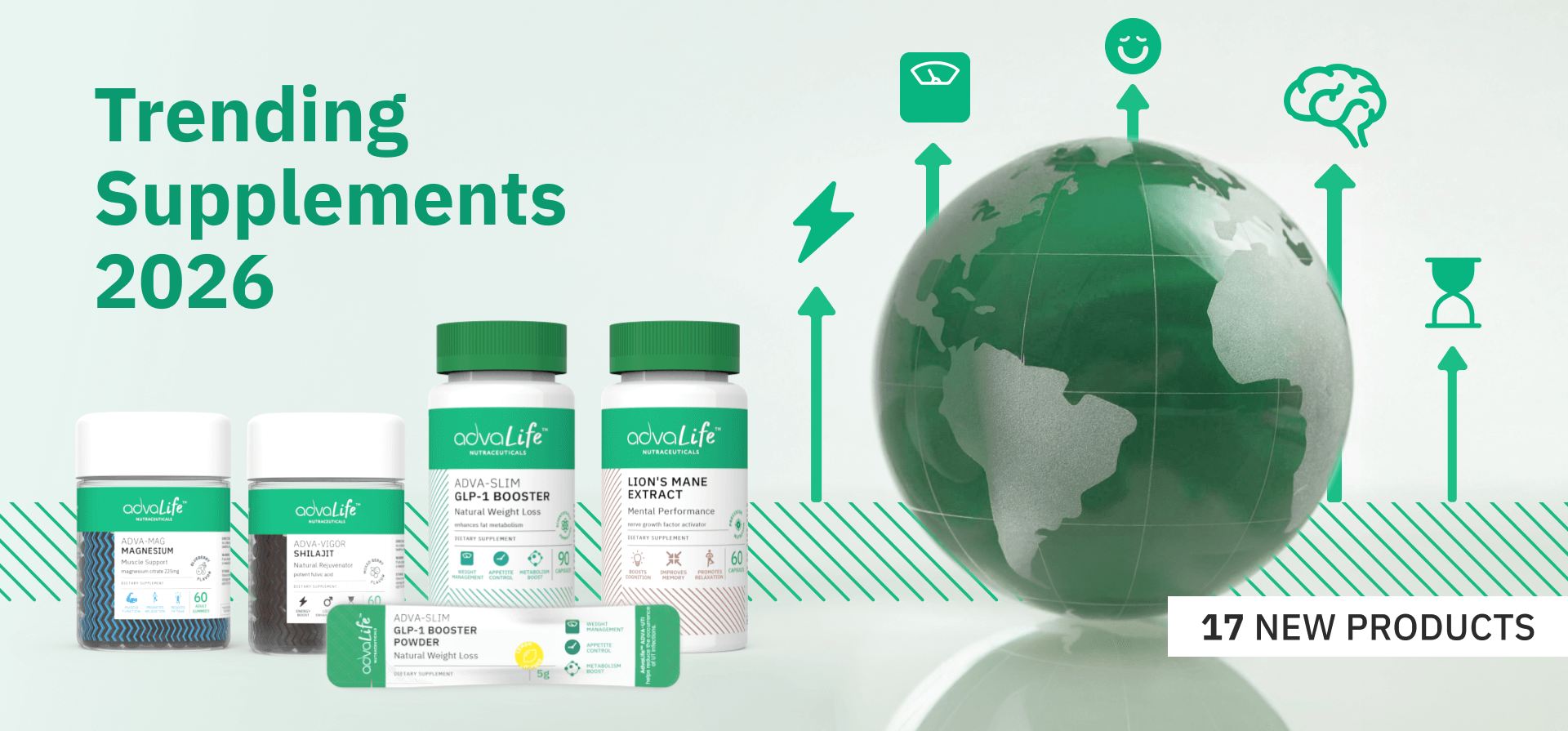

Trending Supplements 2026: 17 High Demand SKUs Distributors Should Add Now

Contents Overview

Explore the new AdvaLife™ range here. In this article, we’ll cover the market opportunities driving supplement growth, the formats consumers prefer, and how the latest AdvaLife™ dietary supplements launch helps distributors strengthen their nutraceutical portfolios, capture demand across trending categories to get ahead of the trend curve, and secure long-term growth with one trusted global brand.

Why Introduce Trending Supplements to Your Portfolio Now?

Distributors that prioritize trending supplement categories and consumer-preferred dosage forms (capsules, gummies, powders) typically win more listings, higher sales velocity, and better blended margins—while building brand loyalty that compounds over time.

- Open more doors, faster: Trend-aligned SKUs (e.g., longevity, metabolic/GLP-1 support, cognitive focus, beauty/nutrition, stress & sleep) give buyers a timely reason to meet, list, and test. Multi-format coverage increases shelf facings across a multitude of distribution channels, expanding your active account base without adding supplier complexity.

- Increase sell-through and average order value: Consumer demand is concentrated in a handful of fast-moving benefit spaces. Curating a range that spans entry SKUs (e.g., collagen, magnesium, ACV gummies) and advanced regimens (e.g., longevity stacks, mushroom nootropics) supports basket building, cross-sell, and repeat purchase, driving up sales per door.

- Lift bottom-line margins with a “barbell” mix: Pair premium trend leaders (e.g., nootropics, adaptogens, longevity) with mainstream volume drivers (collagen, electrolytes, multivitamins). Premiums protect price and raise gross margin, while staples stabilize cash flow and fund expansion—yielding stronger blended profitability.

- Build durable brand loyalty (and LTV): Clear progression paths—from entry products to advanced protocols—create routines, subscription potential, and higher lifetime value. Consistent claims, education, and outcomes in trending categories reinforce trust and encourage repeat purchase under your brand.

- Secure first-mover advantages: Acting early in fast-growing categories helps win category captaincy, better shelf placement, and listing exclusivities before competitors catch up—locking in demand during the strongest growth window.

- Scale with less operational friction: A consolidated, trend-relevant range simplifies sourcing, QA, artwork, and regulatory alignment across markets. Fewer vendors, harmonized specifications, and unified launch assets reduce time-to-shelf and execution risk.

The Market Opportunity: Rising Supplement Demand Across Regions

Dietary supplement use is no longer limited to developed markets, it’s accelerating worldwide.

- Latin America (LATAM): Driven by a growing middle class and increasing awareness of preventive health, Latin America’s dietary supplement market is projected to grow strongly, with Brazil and Mexico leading demand.

- Middle East & North Africa (MENA): The countries in this region are seeing double-digit dietary supplement growth as consumer education campaigns and wellness culture expand, especially in the GCC states.

- Southeast Asia (ASEAN): This explosive region has become one of the most dynamic nutraceutical supplement markets globally, with Vietnam, Indonesia, and the Philippines showing significant year-on-year growth.

A recent report highlights that gummies are the fastest-growing supplement dosage form, projected to grow at a CAGR of over 12% through 2033, while capsules remain the most trusted form for precision and compliance. Powders are expanding too, particularly in sports nutrition and lifestyle wellness.

For supplement distributors, the message is clear: consumers want variety, and they’re willing to pay for it.

Become an AdvaLife™ Partner

AdvaLife™ Supplements Built for What Distributors Need

AdvaLife™ understands that dosage format is a strategic advantage for distributors, not just a product line. By offering this comprehensive range of formats, AdvaLife™ provides distributors with the right tools to meet diverse consumer demand, reduce inventory complexity with trusted, compliant products, and ultimately secure long-term, profitable growth across the nutraceutical landscape.

Deliver Formats Consumers Already Prefer

- Capsules: Capsules remain the gold standard for precision and trust, especially in clinical or premium positioning. For supplement distributors, this capsule dosage format ensures credibility with healthcare providers and health-conscious consumers.

- Gummies: Gummies are now one of the fastest-growing supplement categories globally, appealing to younger demographics and lifestyle buyers. Stocking gummy supplements under AdvaLife™ gives distributors access to a booming, high-margin segment.

- Powders: Powders are lifestyle-driven and versatile, with strong pull in sports nutrition, and wellness routines. With AdvaLife™ supplement powders, distributors can tap into repeat-purchase markets where consumer loyalty is high.

By covering all three leading formats, capsules, gummies, powders, and many more, AdvaLife™ allows supplement distributors to serve diverse consumer segments without relying on multiple dietary supplement suppliers, with one unified brand that meets every demand.

Trendy Supplements Available Across Various Formats

- GLP-1 Support

- Options: Capsules, Gummies, Powder

- Target Consumer: Consumers with varying preferences

- Market Benefit: Maximizes reach by aligning with local dosage trends

- Stress & Energy

- Options: Stress-Relief Capsules, Relaxation & Recovery Gummies

- Target Consumer: Clinical and lifestyle-focused buyers

- Market Benefit: Appeals to diverse consumer types for stress and energy

- Longevity

- Options: NMN Capsules, Shilajit Capsules, Lion’s Mane, Mushroom Complex Capsules

- Target Consumer: Anti-aging and wellness seekers

- Market Benefit: Covers both premium and everyday wellness needs

- Beauty & Lifestyle Wellness

- Options: Collagen Powder, Prenatal Support Gummies, Apple Cider Vinegar Gummies

- Target Consumer: Beauty-conscious and lifestyle-focused consumers

- Market Benefit: Capitalizes on high-repeat purchases and accelerating awareness

- Weight & Gut Health

- Options: GLP-1 Booster Powder, Colon Detox Capsules

- Target Consumer: Weight management and digestive health seekers

- Market Benefit: Positions distributors for the growing demand in weight management and digestive health

Expand with AdvaLife™

Serve Both Premium and Mainstream Markets with One Brand

- Premium positioning: Innovative longevity supplements such as NMN and Lion’s Mane give distributors the ability to target high-value customers who are willing to pay more for advanced wellness solutions.

- Mainstream appeal: Popular lifestyle products like Apple Cider Vinegar Gummies and Collagen Gummies attract everyday consumers looking for affordable, effective wellness options.

Why You Should Partner with AdvaLife™ Now

First-Mover Advantage in Trending Categories

Become the first in your market to distribute supplements like longevity and GLP-1, securing early shelf space before competitors.

Format Flexibility Across Dosage Forms

Enable broader reach across demographics and consumer preferences.

Regulatory Expertise and Global Compliance Support

At AdvaCare Pharma USA, we reduce barriers to entry and accelerate product registrations.

Supply Chain Reliability

Backed by AdvaCare Pharma USA's global network, we ensure consistent availability and minimized operational risk.

Proven Appeal in All Markets

Backed by demand-driven formulations designed for growth in both developed and emerging markets.

Secure Your Position Today

This launch is more than a product update - it’s an opportunity for distributors to future-proof their portfolios with one of the most comprehensive supplement ranges available. With 17 new SKUs across trending categories and consumer-preferred formats, AdvaLife™ is designed to help distributors stay relevant, competitive, and profitable in today’s fast-shifting market.

Contact AdvaCare Pharma today to secure distribution rights for the new AdvaLife™ range and capture your share of tomorrow’s supplement growth. With AdvaLife™, where science meets nutrition for optimal health.

Straits Research (2025): Gummy Market Size and Forecast Report by 2033 Research and Markets Report (2025): Dietary Supplements Market Size

Don't want to miss the next AdvaCare article?

Recommended Content

Pharmaceutical Grade Pet Supplements: AdvaMate™ Quality, USA Quality Standards, & Traceability

Global Pet Supplement Market Trends: Why Distributors are Shifting to Pharmaceutical-Grade Quality

TickZero™: High-Margin, 12-Week Flea & Tick Protection, Distributor Opportunity in LMICs