ASEAN Wellness Boom: Strategies for Supplement Distributors to Succeed in a Growing Market

Contents Overview

ASEAN's Wellness Boom: From Reactive to Proactive

Health awareness has surged across the ASEAN market, particularly post-COVID-19. The region has over 670 million people and a rising middle class. But today's wellness consumers are more informed, digitally connected, and ingredient-conscious.

Rising Demand for Herbal and Natural Supplements Across ASEAN Markets

Consumer preferences across Southeast Asia are transforming. Fueled by a collective shift toward wellness and clean-label supplements, there has been a marked increase in demand for natural, herbal, and plant-based supplements. Across ASEAN markets, consumers seek alternatives to synthetic formulations, favoring botanical ingredients such as turmeric, ashwagandha, ginseng, moringa, ginkgo biloba, and maca.

This rising demand is driven not only by cultural familiarity with natural practices but also by a broader global movement toward holistic health. Consumers increasingly turn to these natural remedies for managing fertility, PMS, stress, fatigue, digestive health, and immunity - dietary supplements, particularly where chronic stress and lifestyle-related conditions are prevalent.

Prevention Over Cure: A Wellness-First Mentality

Post-COVID, health is no longer a reaction; it's a priority. Across ASEAN markets, consumers have adopted a "prevention over cure" approach, seeking dietary supplements to enhance everyday health rather than waiting until illness strikes. This has led to a surge in demand for:

- Daily multivitamins (especially for general immunity and energy supplements)

- Immune-boosting supplements (Vitamin C, D3+K2 Tablets, Zinc Tablets, and supplements containing echinacea and elderberry, like Immunity Gummies such as AdvaLife™ Adva-Shield)

- Hormonal support supplements like evening primrose oil, magnesium, and herbal PMS supplements

- Brain health and stress support supplements, Ashwagandha Gummies, and B-complex vitamins

This trend is particularly notable among young urban professionals, students, and working parents looking for convenient, daily-use formats such as gummies, sachets, and effervescent tablets.

A Cross-Generational Shift Toward Supplements

Unlike other wellness booms that are youth-dominated, ASEAN's supplement trend is cross-generational:

- Millennials and Gen Z proactively purchase dietary supplements for fitness, energy, and cognitive health. Influenced by digital content and social media, they are more experimental with dosage forms like gummies, powders.

- Gen X and older adults gravitate toward joint, bone, and heart dietary supplements. Longevity nutraceuticals like collagen powder, CoQ10 capsules, and omega-3s are particularly popular.

- Parents and caregivers also demand pediatric multivitamins, probiotics, and immune-support supplements.

This diversity in buyer personas requires supplement distributors to diversify product portfolios and dosage forms to appeal to different demographics with differing health goals. A vital step for supplement distributors looking for sustained growth across the ASEAN supplement market.

Digital Health Content and E-commerce Fueling Supplement Awareness

Increased internet access, mobile penetration, and a growing number of health influencers and platforms have radically expanded access to digital health content. ASEAN consumers. Especially in Thailand, Vietnam, the Philippines, and Malaysia, are turning to:

- YouTube channels, TikTok creators, and Instagram health pages for wellness tips

- Health-tracking apps and e-consultation platforms for dietary supplement recommendations

- Online forums and peer reviews are used when choosing between dietary supplements.

This wave of digital literacy has made ASEAN consumers more informed and proactive in their dietary supplement choices. It also enabled supplement distributors to enter these markets with targeted e-commerce campaigns, rather than relying solely on traditional pharmacy or clinic distribution.

Indonesia

Top Supplements:

Vitamin C, Iron supplements, Weight control capsules

Why It's Trending:

Indonesia's wellness sector is being driven by a unique blend of traditional herbal medicine and a digitally connected, youth-driven health movement. Social media influencers and online wellness communities have revived interest in both local and global herbal remedies, from turmeric and ginger blends to imported weight control capsules such as apple cider vinegar capsules.

Regulatory Considerations:

- Supplements must be registered with BPOM (National Agency of Drug and Food Control).

- Halal certification is essential for market acceptance, especially for imported goods.

Vietnam

Top Supplements:

Liver detox blends, Collagen powders, Probiotics, and Herbal capsules

Why It's Trending:

Vietnamese consumers, particularly in urban areas, are focused on beauty-from-within, digestive wellness, and daily vitality. Collagen, Glutathione Capsules, and liver detox supplements are especially popular among women aged 25–45.

Regulatory Considerations:

- Local approval is required for all active ingredients, particularly herbal components.

- The Vietnam Food Administration (VFA) governs safety and labeling.

- Foreign brands must work with a local import license holder for distribution.

Philippines

Top Supplements:

Fertility Supplements (Maca, Evening Primrose), Vitamin D, Energy, and immune support.

Why It's Trending:

Driven by a strong family-oriented wellness culture, supplements for reproductive health, immune defense, and general energy are highly sought after. Demand is rising for affordable yet effective formulations, especially among women and young families.

Regulatory Considerations:

- Products must be registered with the Philippines FDA.

- Blended retail strategies are ideal: combining online sales with brick-and-mortar channels.

- Specific claims on fertility or sexual health require additional scrutiny and documentation.

Thailand

Top Supplements

Garcinia cambogia (weight loss), collagen blends, Ashwagandha, Rhodiola Why It's Trending: Thailand is experiencing a shift from appearance-based beauty supplements to adaptogenic and stress-reduction nutraceuticals. Influencers are driving demand for supplements that promote energy, emotional balance, and gut health, alongside the ongoing popularity of skin-enhancing collagen. Regulatory Considerations:

- Registration with the Thai FDA is mandatory.

- Claims related to weight loss and hormone modulation are heavily regulated.

- Cultural sensitivity in product branding (e.g., tone, packaging colors) influences success.

Malaysia

Top Supplements

Kids’ multivitamin gummies, Omega-3s, and Spirulina.

Why it's Trending:

Malaysia is seeing strong demand for Halal-certified, family-oriented dietary supplements, particularly in maternal and child nutrition. Educational campaigns and social media have amplified awareness of nutrition gaps and daily supplementation.

Regulatory Considerations:

- Supplements must be approved by the National Pharmaceutical Regulatory Agency (NPRA).

- Products must meet Halal requirements, especially in the Malay market segment.

Singapore

Top Supplements

Cognitive support blends such as Ginkgo, Lion's Mane, stress, and sleep formulas.

Why it's Trending:

Singapore's tech-savvy, aging population is investing heavily in supplements for brain health, stress management, and longevity. Consumers here are willing to pay more for high-quality, premium supplements with clinical backing and sustainable sourcing.

Regulatory Considerations:

- Overseen by the Health Sciences Authority (HSA), product registration depends on classification (health supplement vs. therapeutic product)

- No misleading health claims are allowed unless substantiated by scientific evidence.

Products sold online or through cross-border e-commerce must still comply with local standards.

Dosage Forms Driving ASEAN Supplement Sales

Consumer preference is not just about what's inside the supplement, but how it's delivered. Here's a breakdown of the most popular dosage forms across ASEAN:

Form: Why It's Popular

Capsules are preferred for precision and ease, and vegetarian options are gaining popularity.

Tablets are Cost-effective and familiar to older users.

Gummies are exploding in demand, especially among kids and women, for convenience and taste.

Powders are widely used for collagen, detox blends, and green superfoods.

Softgels are Popular for omega-3, vitamin D, Evening Primrose Oil, and fat-soluble vitamins.

Distribution Channels: Offline to Online Shift

The way supplements are being purchased in the ASEAN market is shifting rapidly. While brick-and-mortar stores still matter, digital and social commerce are taking over in several countries.

Country-Based Trends:

Indonesia: Health supplement sales are increasingly driven by video-driven and social commerce growth, enhanced by widespread mobile adoption and digital content engagement.

Vietnam & Philippines: E-commerce in these markets has doubled in size since 2020. In Vietnam, the overall market value surged from $13.7 billion in 2021 to an anticipated $32 billion by 2025, with annual growth ranging from 16% to over 30% in recent years.

Malaysia & Thailand: Both countries display a hybrid retail model, where traditional physical channels are blending with rapid online expansion, particularly in health-focused categories.

Singapore: A digitally mature marketplace where pausable subscription and direct-to-consumer fulfillment models are increasingly favored by health-conscious shoppers.

Key Insight: Social Commerce is becoming a top funnel for dietary supplement discovery, and peer reviews and influencer marketing play a crucial role.

Final Thoughts: Expand or Enter with Strategy

The ASEAN supplement market is not a one-size-fits-all region. Cultural values, consumer priorities, and regulatory frameworks differ from Vietnam to Malaysia, but one thing remains consistent: the wellness economy is booming. Supplement distributors who move now with strategic, compliant, and trend-aligned offerings will be best positioned to thrive.

From strong distributor partnerships to tailored formulations and market registration support, the key to success lies in adaptability and knowledge.

Why Distributors Should Partner with AdvaLife™

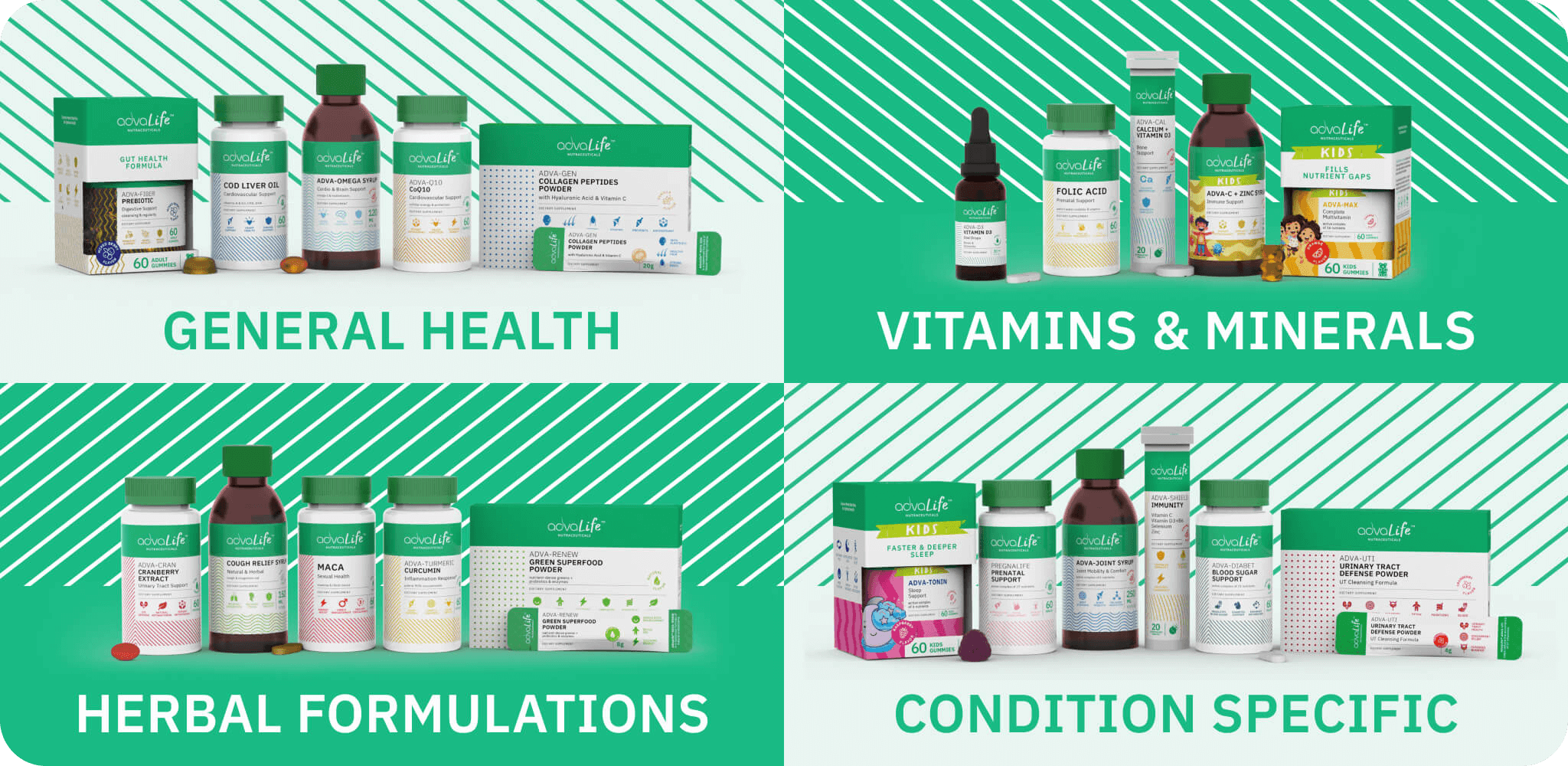

At AdvaLife™, we don't just manufacture high-quality supplements. We empower our supplement distributors with:

- Scientifically backed herbal, multivitamin, and children's formulations

- ASEAN regulatory guidance and compliance support.

- Flexible supplement dosage forms (gummies, capsules, powders, tablets, softgels)

- Education materials and marketing support to help distributors build trust and grow in ASEAN supplement markets.

Ready to capitalize on Southeast Asia's supplement boom?

Partner with AdvaLife™ today - Where Science Meets Nutrition for Optimal Health

GVR 2025: Asia Pacific Dietary Supplements Market Size Report Innova Market Insights 2024: Supplement Trends Asia Pacific Market Overview Mordor Intelligence 2025: ASEAN Probiotic Market Size Report NutraIngrediants 2024: Breaking Barriers: How to Crack Indonesia's Supplement Market Mordor Intelligence 2024: Vietnam Collagen Supplement Market Size & Share Analysis Mordor Intelligence 2024: Fertility Supplement Market Report OpenPR 2024: Malaysia Nutritional Supplements Market GVR: Thailand Collagen Market Size & Outlook, 2024-2030 GVR 2025: Singapore Dietary Supplements Market Size Report, 2030 U.S. Department of Commerce 2023: Vietnam E-Commerce Country Commercial Guide TMO group 2024:Trends in Southeast Asia’s Health & Dietary Supplement eCommerce Market

Don't want to miss the next AdvaCare article?

Recommended Content

Distributors Beware: Avoid These 3 Mistakes and Build Supply Chain Resilience in Medical Devices

The Hidden Cost Ahead: How API Shifts and Tariffs Will Reshape Pharmaceutical Imports in 2026

How Growth in Herbal Treatments is Fueling Shifting Supplement Manufacturing Trends